Quick Cash Advance Services in Anaheim, CA

The Financial Realities of Anaheim

Anaheim is home to Disneyland, bustling tourism, and thousands of hardworking residents who keep the city running. While the local economy is vibrant, not every paycheck stretches far enough. Rent, groceries, and utility bills can pile up—especially for families with variable income. That’s why many turn to quick cash advance services in Anaheim, CA as a safety net.

Why Anaheim Residents Seek Cash Advances

- Tourism & seasonal work: Hospitality jobs often come with fluctuating hours.

- High rent markets: Orange County housing costs push many residents’ budgets to the limit.

- Everyday emergencies: From medical co-pays to urgent car repairs, life doesn’t wait for payday.

How Cash Advances Work in Anaheim

A cash advance in Anaheim allows residents to borrow a small amount of money for a short term. Here’s how it works at Cash Now California:

Payday Loans and Responsible Borrowing

Across California, payday loans provide a financial lifeline for people facing emergencies. But like any tool, they need to be used responsibly. At Cash Now California, we emphasize not only quick access to funds but also education on responsible borrowing practices.

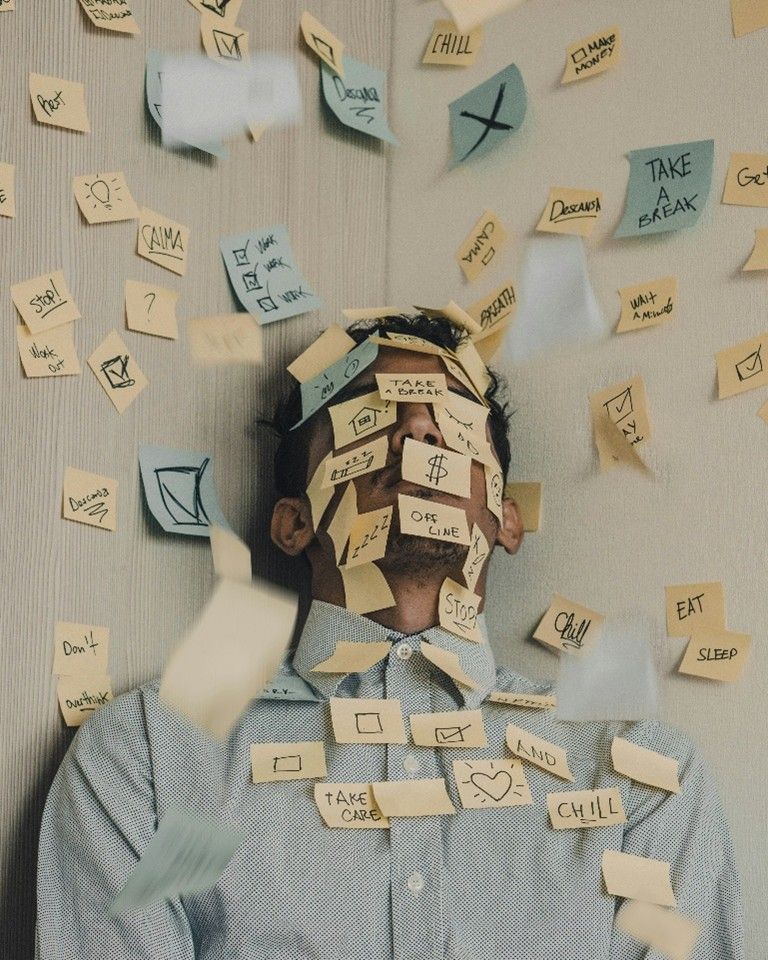

Tip #1: Borrow Only What You Need

A payday loan should be tied to a specific emergency—rent shortfall, medical bill, or urgent car repair. Avoid borrowing extra “just in case,” which increases repayment challenges.

Tip #2: Understand the Costs Upfront

In California, payday loans are regulated under the

California Deferred Deposit Transaction Law (CDDTL). This means fees and repayment schedules must be disclosed. At Cash Now California, we provide transparent terms so there are no surprises.

Tip #3: Plan for Repayment Before You Borrow

Set aside money from your next paycheck or budget in advance. This prevents a rollover situation where you might feel pressured to take another loan.

Tip #4: Avoid Multiple Loans at Once

Stacking loans from different lenders can quickly spiral into unmanageable debt. Stick with one loan at a time.

Tip #5: Use Payday Loans as a Bridge, Not a Habit

Payday loans are designed for emergencies—not ongoing budget shortfalls. If you find yourself relying on them regularly, it may be time to explore financial coaching or budgeting support.

How Cash Now California Supports Responsible Borrowing

- Educational resources: Blog posts, email series, and staff guidance.

- Clear communication: No hidden fees, no misleading terms.

- Community focus: We see ourselves as more than a lender, we’re part of the neighborhoods we serve.

Conclusion: Empowering California Borrowers

Used wisely, payday loans can be a valuable financial tool. By borrowing only what’s needed, planning repayment, and choosing a transparent lender, California residents can avoid pitfalls.

Cash Now California is here to provide fast loans and trustworthy guidance. Apply online today and borrow responsibly.