How to Spot Subscription Fees That Are Quietly Draining Your Account

Photo by Markus Winkler on Unsplash

Subscriptions are sneaky.

- $4.99 here

- $11.99 there

- A “free trial” that wasn’t actually free

- An app you forgot about

- A streaming service you haven’t watched in months

Before you know it, $50–$200 a month disappears with zero benefit.

This article will help you identify, track, reduce, and monitor subscription fees — without shame and without telling you to “just cancel everything.” Life is busy and expensive enough. This is about awareness, not blame.

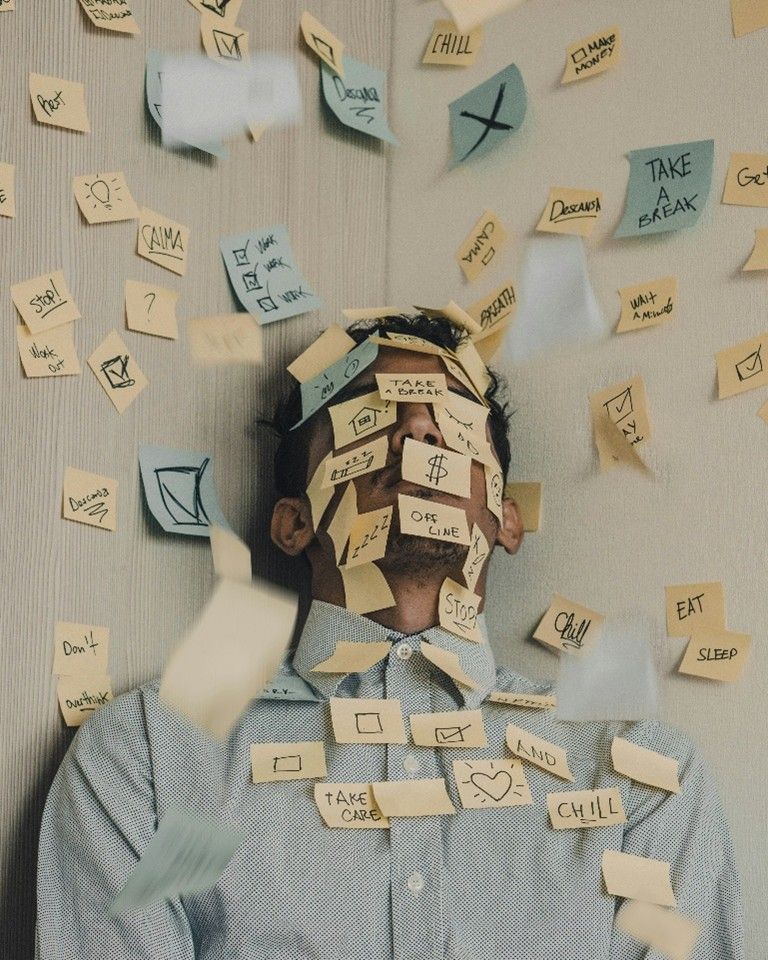

1. Why Subscriptions Have Become So Hard to Track

Years ago, most bills were simple:

- Rent

- Car insurance

- Cell phone

- Groceries

Now, the average American has 10–17 active subscriptions — many of which renew automatically.

Why?

- Companies switched to monthly billing to make things feel cheaper.

- Trials auto-convert before you remember to cancel.

- Charges show up as vague names on your statement.

- Subscription fees hide inside ACH debits.

It’s not you — the system is designed this way.

2. How Subscription Charges Usually Appear on Your Bank Statement

These transactions often look like:

- APPLE.COM/BILL

- *GOOGLE Services

- AMAZONPRIME

- SPOTIFYUSA

- NETFLIX.COM

- MICROSOFT*SUB

- PAYPAL INST XFER

- SQC*CASHAPP

They mix in with normal spending, making them hard to identify.

3. The Four Types of Subscriptions That Drain Accounts the Most

A. Streaming & Entertainment

Netflix, Hulu, Disney+, Max, Spotify, YouTube Premium…

Most households don’t use half of what they’re paying for.

B. Trial Offers That Convert

Free trials turn into paid subscriptions automatically. The bank statement version rarely shows the brand clearly — it shows the processing company, not the service.

C. App Store Purchases

They show up as:

- APPLE.COM/BILL

- GOOGLE *CHARGE

Meaning you may not remember what the actual app was.

D. “Utility-Style” Subscriptions

These fly under the radar because they feel like necessities:

- Cloud storage

- Identity protection

- Antivirus

- Phone insurance

They add up quickly.

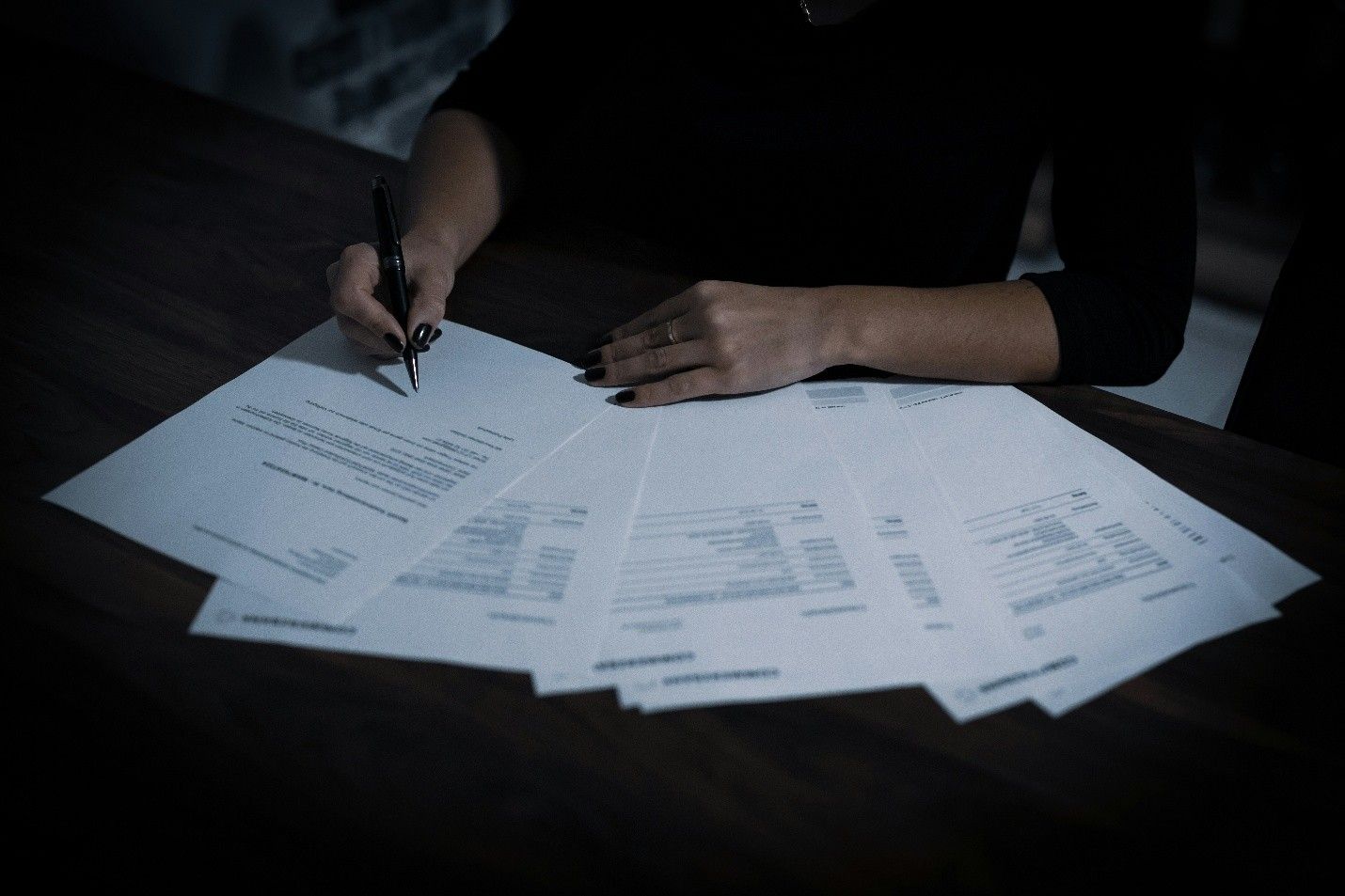

4. How to Conduct a 15-Minute Subscription Audit

You only need three things:

✔ Your bank statement

✔ A highlighter

✔ A calculator (optional)

Step 1: Highlight Anything Repeating Monthly

Look for patterns.

Step 2: Search Each Descriptor

If it says “APPLE BILL,” look inside your Apple ID purchase history.

Step 3: Add Up the Total Monthly Subscription Spend

Most people are shocked.

$9.99 + $9.99 + $5.99 + $12.99 + $14.99…

Suddenly you’re at

$80–$150 a month.

Step 4: Cancel What You Don’t Use

Cancel from the source, not the bank.

Banks cannot stop subscription payments permanently — they can only block a single charge.

5. Hidden Subscription Traps to Watch For

1. “Annual Renewals” You Don’t See Coming

You sign up once, forget about it, then BOOM — $99 or $149 disappears.

2. Kids’ App Charges

Very common.

Banks classify them as normal purchases.

3. Subscriptions Attached to Old Phones

Cloud storage, insurance, or premium tools may still be active even after upgrading.

4. Apps You Forgot Existed

Fitness apps, language apps, editing apps, meditation apps…

6. How Subscription Fees Lead to Overdrafts

Subscription fees typically hit:

- Late at night

- Early morning

- Before paycheck deposits

So even a $7.99 charge can cause a cascade of:

- Overdraft fees

- Returned ACH payments

- Bank account holds

It’s not irresponsibility — it’s bad timing and high cost of living.

7. Tools That Help You Track or Cancel Subscriptions

Free or low-cost tools:

- Truebill (Rocket Money)

- Mint

- Copilot

- Bank-provided alerts

You don’t need fancy budgeting skills — just awareness.

8. A Healthy Mindset Around Subscriptions

This article is not about guilt.

Subscriptions aren’t bad. Life is stressful, and sometimes convenience is worth paying for.

The goal is not to cancel everything — the goal is to be aware and make choices that give you breathing room.

9. When to Review Subscriptions

Try this schedule:

- Monthly: Quick scan of bank statement

- Quarterly: Full subscription audit

- Yearly: Review all annual renewals

You’ll save more than you expect.

10. Final Thoughts: You Deserve Transparency

Many Californians are struggling because of high rent, high grocery costs, and unpredictable expenses — not because they’re “bad with money.”

Understanding subscriptions simply helps you keep more of your money where you want it.

And if you ever want help reviewing your finances before applying for a loan, we’re here to walk through it with you — without judgment.