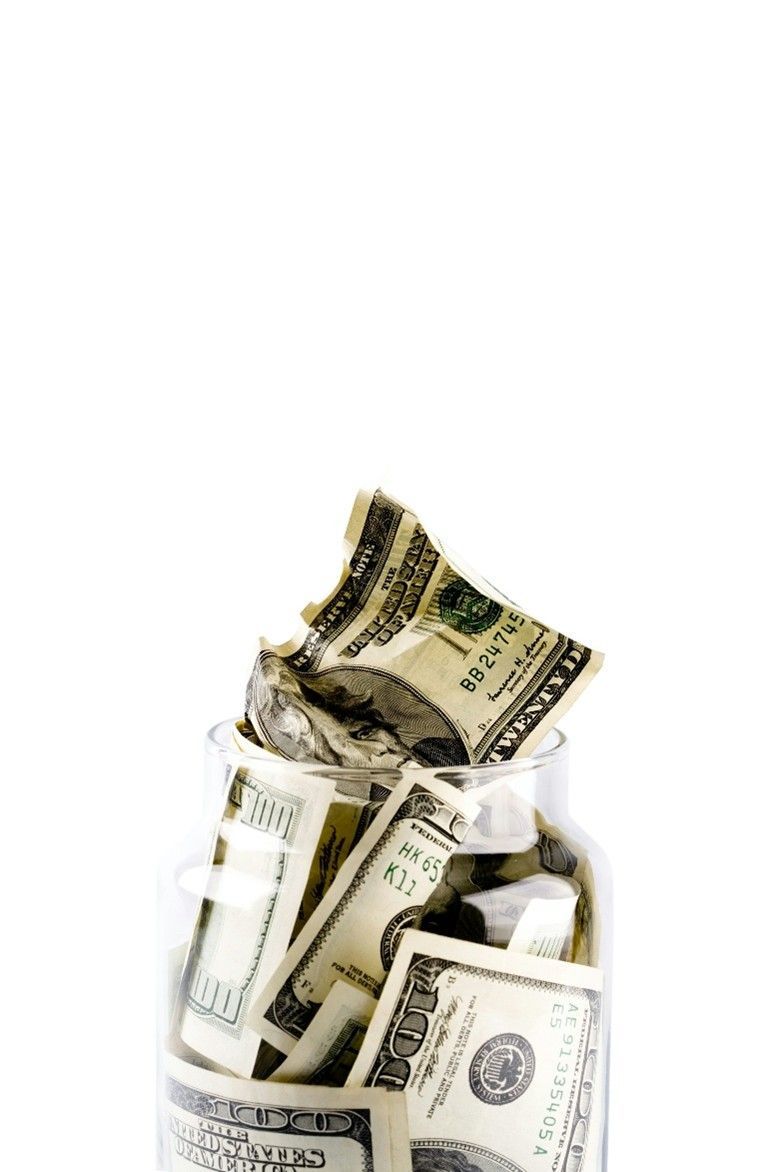

The Gentle Guide to Building an Emergency Fund (Even If It’s $5 at a Time)

Photo by Towfiqu barbhuiya on Unsplash

Most financial advice online sounds unrealistic:

- “Save 6 months of expenses.”

- “Put away $500 right now.”

- “Build a $5,000 cushion.”

For many Californians, that advice feels out of reach. Rent alone can be $2,000–$3,000. Groceries keep climbing. Gas is unpredictable. No one has $500 sitting around “just in case.”

So let’s make this practical.

Let’s make it gentle.

Let’s make it doable.

This is your guide to building an emergency fund slowly, realistically, and without shame — even if you’re starting with $5 at a time.

1. What an Emergency Fund Actually Is

An emergency fund is simply:

Money set aside to protect you from life’s surprises.

It is NOT:

- A sign of wealth

- A sign of perfect budgeting

- Something that has to grow overnight

It’s a gradual cushion that gives you peace of mind.

2. Why Small Savings Matter More Than Big Ones

Here’s the truth:

Saving $5 consistently is better than saving $100 once.

Why?

- Small savings = repeatable

- Small savings = accessible

- Small savings = predictable

- Small savings don’t overwhelm your monthly bills

Small habits lead to big results.

3. Why Saving Is So Hard in California Right Now

Let’s acknowledge the reality:

- Groceries cost more

- Rent is high

- Utilities fluctuate

- Wages have not kept up

- Emergencies feel constant

Saving isn’t hard because of poor choices — it’s hard because life is expensive.

This guide removes the pressure and focuses on what you can do, not what you “should” have done.

4. Start With One Goal: $50

Not $500. Not $1,000.

Just $50.

Why?

- It feels achievable

- It builds confidence

- It reduces stress

- It creates momentum

Once you hit $50, move to the next milestone.

5. The Step-By-Step Emergency Fund Plan

Step 1: Save $5–$10 a Week

Even if money is tight, $5 is doable.

Put it in:

- A separate savings account

- A cash envelope

- A prepaid card

- An online vault

The point is to separate it from your spending money.

Step 2: Build to $50

This cushion can cover:

- A small bill

- A co-pay

- A low-cost emergency

- A fee

- A school cost for kids

Reaching $50 shows you what’s possible.

Step 3: Grow From $50 to $150

Now you’re building stability.

At $150, you can handle:

- Gas during a tight week

- Minor car repairs

- Unexpected childcare needs

Step 4: Aim for $300

This is the point where an emergency fund really makes you feel safe.

$300 protects you from:

- Sudden bill spikes

- Bare-minimum car repair

- Last-minute travel

- Medical deductibles

- Utility disconnections

Step 5: Refill Whenever Life Happens

An emergency fund is not meant to sit untouched.

You

will use it.

That’s the point.

Use it. Then refill it. No guilt.

6. Where to Keep Your Emergency Fund

Choose somewhere that is:

✔ Safe

A bank savings account is ideal.

✔ Separate

So you don’t accidentally spend it.

✔ Easy to reach in a real emergency

But not too easy.

7. How to Find $5–$10 a Week Without Feeling It

Here are gentle options:

- Use digital “round-up” savings

- Save leftover cash

- Skip 1 small subscription

- Choose a cheaper version of one item per grocery trip

- Sell something unused once a month

You do not have to cut everything — just find small pockets of opportunity.

8. What NOT to Do When Building an Emergency Fund

Do NOT:

- Feel guilty if you can’t save every week

- Compare yourself to others

- Think you’re behind

- Try to save too aggressively and stress yourself

- Punish yourself for using the fund

Gentle progress is real progress.

9. How to Protect Your Fund From Accidental Spending

Here are helpful rules:

- Keep it in a separate account.

- Name the account something emotional like “Peace of Mind.”

- Treat it as off-limits unless it’s truly needed.

- Set up automatic savings if possible (even $5).

10. Celebrate Every Milestone

Celebrate:

- $20 saved

- $50 saved

- $75 saved

- $100 saved

- $300 saved

Small wins matter. They build confidence.

11. When You Should Use Your Emergency Fund

Use it when:

- A bill is due before payday

- A car needs urgent repair

- A medical cost pops up

- A child needs something important

- You fall short on groceries

- A work expense arises unexpectedly

If it removes stress, it qualifies.

12. What to Do After You Use It

Just refill it slowly.

No guilt. No pressure.

Even if you refill with:

- $5

- $10

- Spare change

- Unexpected refunds

- Cash gifts

It all counts.

13. Emergency Fund vs. Long-Term Savings

These are two different things.

Emergency Fund = Protection

Short-term safety.

Long-Term Savings = Goals

Vacations, moving, bigger purchases.

Start with protection first.

14. Why This “Gentle” Method Works

Because it’s:

- Realistic

- Flexible

- Encouraging

- Built around your real life

- Designed for rising California costs

- Sustainable long term

Saving shouldn’t feel like punishment. It should feel like security.

15. Final Message: You Can Do This

You don’t need thousands of dollars to feel secure.

You don’t need perfect budgeting.

All you need is a gentle, realistic path forward.

If you ever want help reviewing your finances or planning ahead before applying for a loan, we’re here to support you — always without shame.

You’re doing your best.

Keep going, one small step at a time.

Even $5 matters.