December 5, 2025

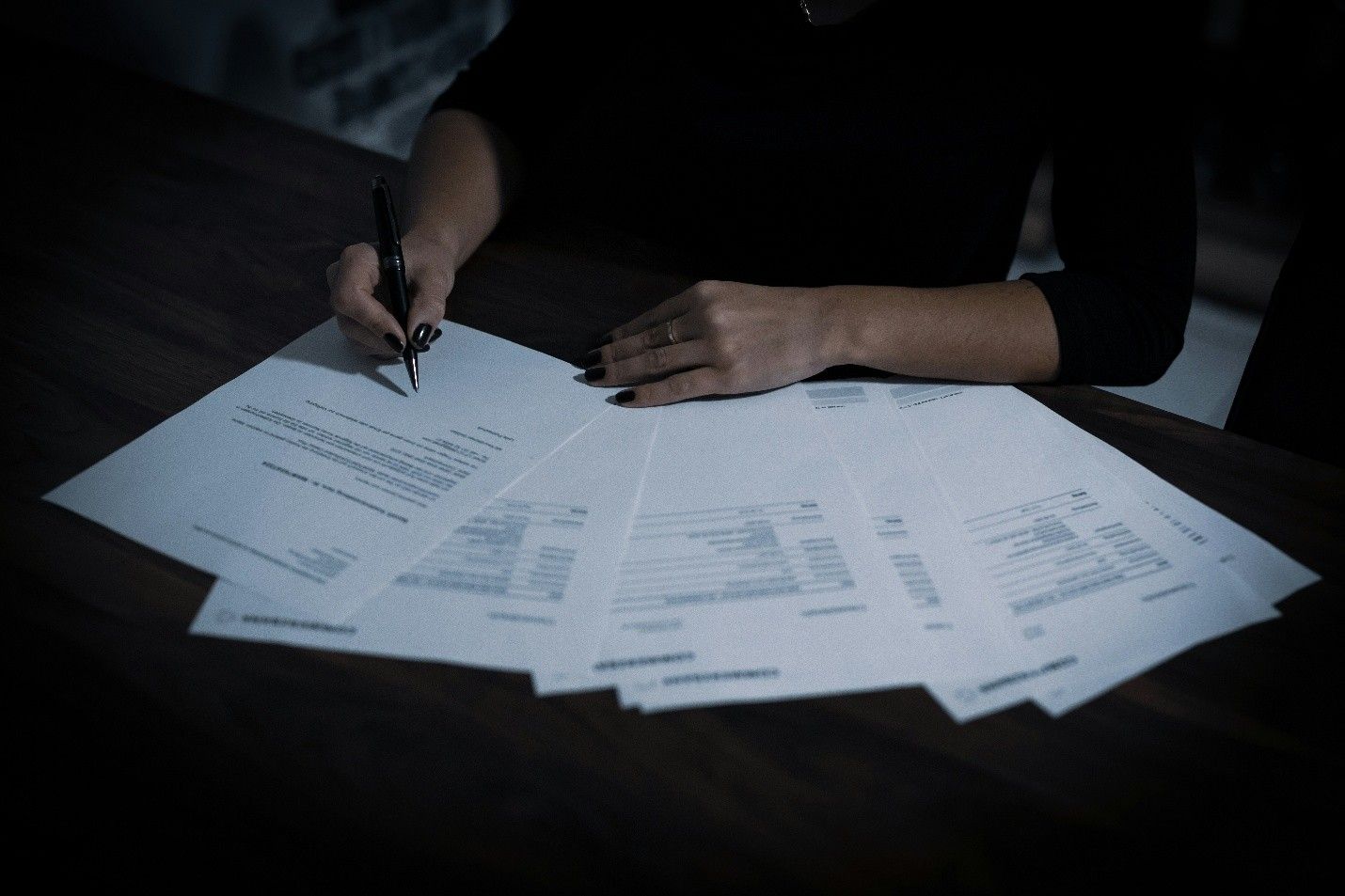

Photo by Van Tay Media on Unsplash Understanding your bank statement shouldn’t feel like reading another language — but for many people, it does. Between confusing abbreviations, pending transactions, holds, reversals, returns, and fees, a simple monthly statement can turn into a puzzle no one asked to solve. At Cash Now California , we talk with hundreds of customers every month who tell us the same thing: “I’m trying to do better with my money… I just don’t understand what I’m looking at on my bank statement.” If that’s you, you are not alone. And you are not behind. Banks don’t exactly go out of their way to explain things clearly. This guide breaks everything down in plain English — no judgment, no jargon, no assumptions. Just clarity. 1. Why Your Bank Statement Matters (Even If You Don’t Budget) Your bank statement is basically a story of your month — where money came in, where it went, and whether anything looks unusual. It matters because: It helps you spot fraud or unauthorized charges early. It helps you know exactly when deposits arrive (important for planning bills). It helps you avoid overdrafts or returned payments . It helps you see patterns you may not notice day-to-day. Most people are not overspending — they're overwhelmed, busy, or dealing with rising prices. Knowing how to read your statement gives you back a sense of control . 2. The Different Parts of a Bank Statement Not every bank uses the same layout, but most statements include: ✔ Beginning Balance What you had at the start of the month. ✔ Ending Balance What you had at the end. ✔ All Deposits Paychecks, cash deposits, refunds, transfers, benefits, etc. ✔ All Withdrawals Debit card purchases, ACH debits, bill payments, transfers, ATM withdrawals. ✔ Holds or Pending Transactions These are temporary and may settle at a different amount. ✔ Bank Fees For example: Overdraft fees NSF (non-sufficient funds) fees Monthly maintenance fees ✔ ACH Transactions These include: Automatic bill payments Direct deposit Loan payments Subscription services Apps like Cash App, Venmo, PayPal ACH = electronic bank-to-bank transaction. Understanding ACH is crucial, especially when budgeting. 3. Common Abbreviations Banks Use (And What They Really Mean) POS Point of sale — usually a debit card purchase. DBT / DBT CRD Debit card transaction. ACH Automated Clearing House — electronic payment. RET / R01 / R02 Returned ACH payment because of insufficient funds or bank restrictions. HOLD A temporary freeze on funds until the transaction clears. NSF Non-sufficient funds. REV / REVERSAL A charge reversed or refunded. Banks love abbreviations. You shouldn’t need a dictionary, but here we are — so now you have one. 4. How to Check for Errors or Fraud Fraud doesn’t always look dramatic. It often starts small: A $1 "test charge" A $4.99 subscription you never signed up for Two charges for the same purchase A deposit missing Here’s what to look for: ✔ Small Charges You Don’t Recognize Fraudsters test the card before hitting it harder. ✔ Two Charges From the Same Store One may be a pending charge — but always check. ✔ ACH Debits You Did Not Approve These must be reported immediately. ✔ Subscription Services You Forgot About More on that in the next article. ✔ Merchants You Never Visited Anything out of your normal routine should be reviewed. 5. Understanding Pending vs. Posted Transactions This is where many people feel confused. Pending = Temporary The transaction is in progress. The amount may change . Example: A gas station may place a $125 hold , but you only pumped $30. Posted = Final This is the real amount that clears your account. Important: If you're budgeting tightly, pending transactions can make it look like you have more money than you actually do. 6. How Returns, Declines, and ACH Reversals Show Up When a payment is returned by the bank, you may see codes: R01 – Insufficient Funds The money wasn’t available. R02 – Account Closed R03 – No Account / Unable to Locate R05 – Unauthorized Debit These codes help merchants identify what happened — but they also help you understand your own account activity. 7. How Reading Your Statement Helps Prevent Overdrafts Once you understand: How pending charges work How ACH debits hit When refunds post How subscription fees hide …you can better predict your true balance , not just what the app shows. Mistakes happen. Life gets expensive. You're not meant to keep all this info in your head — that’s why a quick monthly review is so powerful. 8. A Simple 5-Minute Routine to Understand Your Finances Here’s a routine anyone can do: Open your statement for the month. Highlight deposits in green . Highlight anything you don’t recognize in yellow . Look at bank fees (circle in red ). Write your beginning and ending balance on a sticky note. That’s it. In just 5 minutes, you’ll have more clarity than 90% of people. 9. What to Do If You See Something Wrong If you find an error: Call your bank ASAP Ask for the electronic signature tied to the charge Ask for the transaction descriptor Request a merchant inquiry If necessary, file a dispute Not everything is fraud — sometimes it’s delays, double postings, or pending issues — but it’s your right to verify. 10. Final Thoughts: You Deserve to Understand Your Money You’re not supposed to magically understand banking terms nobody teaches. Money is complicated, life is complicated, and you’re doing the best you can. At Cash Now California, we believe knowledge builds confidence — not shame. If you ever need help understanding your account before applying for a loan or making a financial decision, we’re here to talk through it with you.